Guide to Letting

At Lovett&Co. Estate Agents, we understand that renting a property can be daunting and time-consuming. There are a lot of important decisions to make, from choosing the right letting agent to understanding your landlord’s responsibilities. That’s why we’ve created the guide to renting a Property.

This comprehensive guide covers everything you need to know about renting, from start to finish. We’ll help you choose an experienced and reputable agent, navigate the legal landscape, and get the most out of your property. And because we’re experts in the market, we can help you avoid potential pitfalls and make the entire process stress-free.

What are the reasons to become a landlord?

The recent change in the mortgage landscape has had an interesting effect on the property market. With high loan-to-value (LTV) mortgages becoming harder to come by, many would-be buyers have been forced to delay their plans to invest in property. However, this has had the unintended consequence of boosting the buy-to-let (BTL) market. Due to favourable BTL mortgage rates, letting a property has become a viable way of making money and allowing you to invest in it. As a result, we see more and more people taking advantage of this opportunity. With the right approach, BTL can be a lucrative and rewarding investment.

Renting with a Mortgage

Unless you’re in a position to buy with cash, a buy-to-let mortgage is usually required when you’re planning to rent out a property. If you already have a mortgage on the property you want to rent, you’ll need to get consent from your lender before you can let it. Most owner-occupier mortgage deals include a clause that doesn’t allow the property to be rented out.

Once you have your lender’s consent, you’ll need to take out a buy-to-let mortgage. Buy-to-let is a specialised mortgage designed for people planning to rent out their property. Buy-to-let mortgages usually have higher interest rates than owner-occupier deals, so it’s important to compare different offers before you apply.

The lender will require you to prove that the rental income will cover the mortgage payments when providing a buy-to-let mortgage.

They may also ask for a larger deposit than they would for an owner-occupier mortgage. The minimum deposit for a buy-to-let mortgage is usually 25%, but some lenders may require more.

Several risks are involved, but with the right advice and careful planning, you can minimize these. Talk to an experienced agent today to find out more about how you can make money from investing in property.

Income Potential

You will likely be interested in investing in a buy-to-let property if you want to make money. You can make this happen in two ways: profit from the tenants and capital gains on the property value.

It is possible to lose money in turbulent times. This could happen if your property’s value decreases, if you have long void periods, or if your outgoings exceed the rent received. As with any investment, there can be financial risks, so it is worth talking to an agent before you purchase or rent a property. However, property values have consistently increased over the long term, and this trend does not appear ready to stop any time soon.

Investing in buy-to-let properties can be a great way to make money, but it is important to do your research before taking the plunge.

Expenses

Before you invest in property, you should make yourself aware of the fees involved.

These include:

Stamp Duty

Property Survey

Legal costs

Valuation (lender)

Mortgage fees

Income tax

Beyond those initial purchase costs, there are the ongoing fees involved.

These include:

Mortgage interest

Insurance

Safety checks

Maintenance and repairs

Rental Insurance

Let management agent fees

HMOs v Non-HMO property

A house in/of multiple occupation (HMO) is a property occupied by unrelated people who share facilities such as the bathroom, kitchen or living room. HMOs come in all shapes and sizes, from converted single rooms to large properties that have been purpose-built for multiple occupancy. To be classed as an HMO, a property must meet certain criteria, including being occupied by five or more people and having shared facilities. If you’re considering letting an HMO, it’s important to seek professional advice from a local agent. HMOs are subject to different rules and regulations than non-HMOs, so you must understand the implications of letting an HMO before you move forward.

Differences between HMOs and non-HMOs

As a landlord, you must ensure that your property meets certain standards. This includes ensuring that the property is safe and habitable for tenants. If tenants believe the property does not meet these standards, they can complain to the local council. The council’s Environmental Health Department will investigate the complaint, and if they find issues with the property, they may order the landlord to correct them. In some cases, the council may also prosecute landlords if they fail to comply with council orders. As a result, landlords must take complaints from tenants seriously and take action to ensure that their properties meet the required standards.

Every five years, electrics are tested and must meet standards to continue being used. Smoke and carbon monoxide detectors must be fitted. You must also ensure that there is no overcrowding in the property, as this can pose a health and safety risk. Additionally, cooking and washing facilities must be up to code, and communal areas must be clean and in good condition. If you fail to meet these standards, you could face legal action from your tenants or the council.

Choosing the right letting agent

Before you choose a letting agent to help you market your property and find the best tenants, you should consider several things. At our agency, we pride ourselves on exceeding the expectations of our landlords. You should choose an experienced agent to properly manage your property and find high-quality tenants. We recommend doing your research early on to have plenty of time to compare your options.

To narrow your list of potential agents, start by asking for recommendations from trusted family and friends who have had recent experiences with letting agents in the area. You can also compare local agents by reading online reviews.

Other consumers can be a great source of information when it comes to finding the right agent for your needs. Once you have narrowed your list to three agents, invite them to evaluate your property’s monthly rent potential. This will give you a chance to see how they operate and get a better sense of their qualifications. With careful research, you can find the perfect letting agent to help you successfully rent out your property.

How is a property's rental value obtained?

Your rental value is calculated by considering all of the following:

- Current rental market values in a similar area

- The target market (students, young professionals, families, etc.)

- The current state of repair and planned works

- Interior decoration (how modern, how clean, how cosy)

- Transport links, local amenities, schools

- Local demand predictions

Our property management services

At Lovett & Co, we offer three levels of property management: Fully Managed, Rent Collect, and Tenant Finder.

Tenant Finder

Tenant Finder is our most basic option. We charge £390 for locating and vetting a tenant for your property. Once the tenant has been vetted, and the paperwork is complete, our involvement ends, and you should enjoy years of hassle-free rent.

Rent Collect

Rent Collect is perfect for those who live further afield or are too busy to chase late rent payments. We will collect the rent from your tenants on your behalf and transfer it to you for a small monthly fee.

Property Management

Property Management includes the above options, but in addition, we will conduct regular inspections of your property and manage all maintenance issues on your behalf. This is our most comprehensive offering and gives you complete peace of mind that your property is being well looked after. For more information on our services, visit our Letting Services page.

In addition to property management, we offer Inspire Pro. This service includes a guaranteed monthly rent (up to 15 months) and up to £100,000 in legal costs. We will perform all appropriate steps to deal with tenants who fail to pay or heed a Section 21 notice.

Preparing and Marketing for Tenancy

If you’re looking for a tenant to rent your property, we can help. We understand landlords have three key concerns: getting a quick let, attaining the highest price, and ensuring their property investment is safe. We’ll do our best to address all of these concerns and sign the terms once we’ve received them.

To get started, your property details, including photographs and floor plans, will be advertised on major property portals, like Rightmove or Zoopla. We will also upload your property to our website and ensure it’s presented in its best light.

We’ll vet all documentation and let you know if there are additional steps you need to take, such as gas inspections or an Electrical Installation Condition Report (EICR). We’ll also keep you abreast of the latest regulation changes to ensure that you remain compliant in all property matters.

Receiving Offers and Preparing to Rent

Once we have a potential tenant interested in the property, we will do the following:

- Tenant credit referencing

- Take photos to help you organise your inventory

- Prepare a Tenancy Agreement

- Prepare a standing order

- Arrange for a Gas Safety Certificate (EICR)

- Make sure the property is available for tenants to move in.

- Get the property ready to be rented

- Electric and gas appliances

At the beginning of the tenancy, the tenant must be given a gas safety certificate and an EICR. The appliance must be safe to use and in good working order. The electrical items must also be safe and in good working order if provided with the property.

The landlord is responsible for ensuring that the property is fit for human habitation at the beginning of the tenancy. Failure to provide the above certification will prevent you from issuing a section 21 notice, resulting in lost income and considerable stress.

Carbon Monoxide and Smoke Alarms

All landlords must have at least one smoke alarm on each floor of a property. These alarms must be functional and checked on the first day of the tenancy. The tenant is responsible for regularly checking them until the end of their tenancy. Not only will this help to ensure the tenant’s safety, but it will also help protect the landlord’s property. In addition, you must now install carbon monoxide alarms in any room with a solid fuel appliance (wood stove). This is important in keeping tenants and landlords safe from potentially deadly fumes.

Energy Efficiency

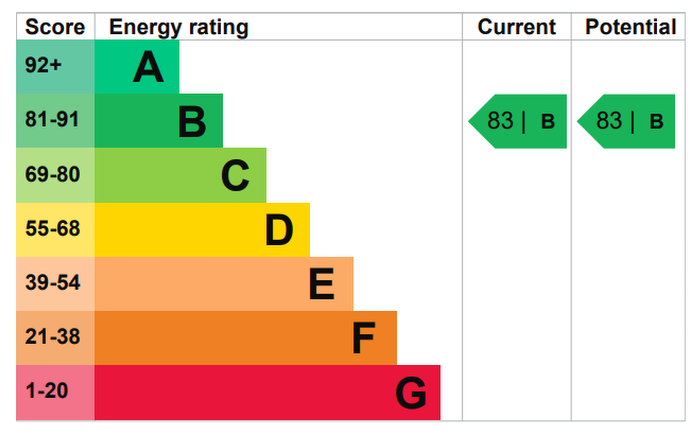

In order to comply with the law, all landlords must have an Energy Performance Certificate (EPC) for their property that is registered and up-to-date. The legal regulation came into effect in April 2018, requiring all eligible properties to have an EPC rating of E or higher. Not only do landlords need to provide their tenants with an EPC, but tenants also have the right to request permission from their landlord to improve the energy efficiency of the property they are renting. Additionally, landlords are not allowed to refuse such requests from tenants. Another way to help improve energy efficiency in rental properties is by installing smart meters.

Water safety

As a landlord, you are responsible for ensuring that your water supply works properly to protect your tenants from Legionella. Legionella is a bacteria that can cause Legionnaires’ disease, a severe form of pneumonia. The bacteria can thrive in water systems, and people can become infected if they inhale water droplets that contain the bacteria. Legionnaires’ disease is particularly dangerous for people with weakened immune systems and can be fatal. As such, landlords must prevent Legionella growth in their properties. This includes ensuring that the hot water system is properly maintained and that any stagnant water is cleared away quickly.

Furniture

When a tenant moves into a property, they will usually have the option of three different types of furnishing packages.

- Unfurnished: This can mean there is nothing inside the property outside of the kitchen appliances, or it can mean curtains, carpets, or white goods are included.

- Part-furnished: Includes curtains and carpets, specific white goods, and larger furnishing, such as wardrobes and beds.

- Fully furnished: This signifies that the property is ready to be moved in, with (potentially) everything from cutlery to a television.

The level of furniture in the property should be made clear in the tenancy agreement. It is important to remember that if you supply furniture as part of the let, it must comply with fire safety regulations.

Setting up the tenancy and moving In

The Paperwork

As a landlord, it is important to protect your investment and ensure that your tenant is clear on the terms of their tenancy. The first step is to provide a tenancy contract. While you are free to create your agreement, we recommend using a standard form reviewed by professional legal counsel. We have such an agreement available to our clients upon request. This will help ensure that all key terms are covered and both parties are protected.

Once the contract is drawn up, it is essential to give the tenant time to review it and ensure they understand all of the terms. Finally, remember to clearly state who is responsible for paying utility bills and council taxes. In most cases, the tenant will be responsible for these payments, but this should be stipulated in the agreement to avoid any confusion or misunderstandings down the road. By taking these simple steps, you can help to safeguard your property and ensure a smooth relationship with your tenant.

Moving In

When you hand over the keys to your tenants, you’re entrusting them with your property. How much contact you have with them afterwards will depend on the level of service you’ve chosen. A fully managed service means that your agent will take care of everything, from finding tenants and conducting viewings to drawing up the tenancy agreement and arranging repairs. This can be a great way to reduce your workload, but it also means that you’ll have less control over what’s going on at your property.

You can smoothly transition a house into a rental property by following a few key recommendations. First, it is important to remove all personal items from the home. This includes photographs, paintings, and other decorations specific to your taste.

Additionally, you should leave instructions manuals for any appliances included in the rental. This will help your tenants to understand how to use the appliances properly and avoid any damage.

Finally, it is helpful to place picture hooks on the walls so your tenants can hang pictures. By following these simple recommendations, you can help ensure a smooth transition for you and your tenant.

Remember that you remain responsible for the maintenance and good condition of the property throughout the tenancy.

Once those keys are handed over, congratulations! You’re now a landlord! If you’re ready to start, contact us for a quick chat..